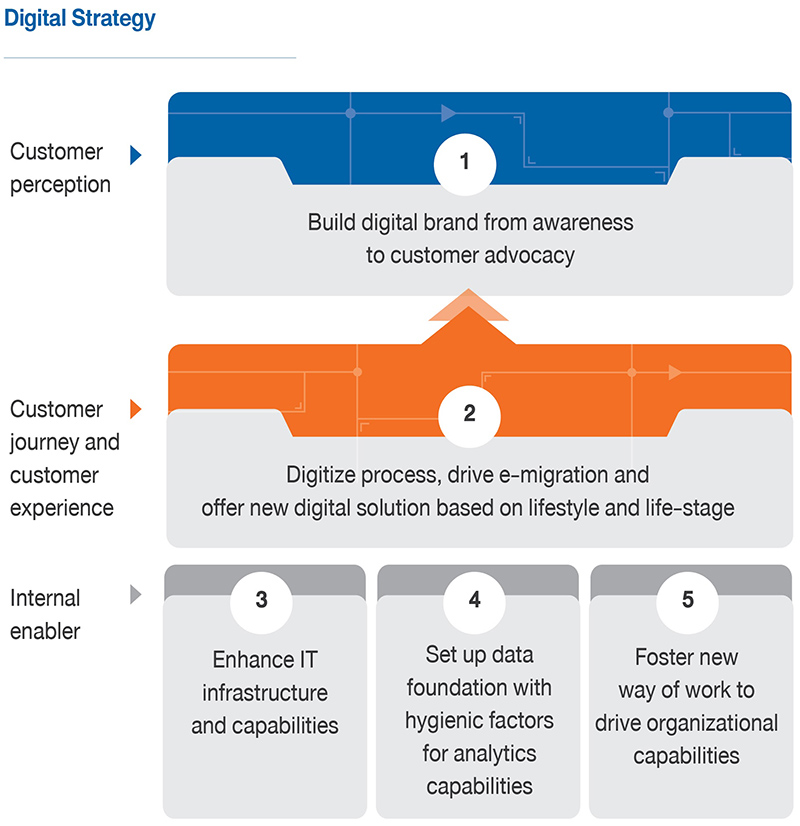

Digital Strategy

Never before has the banking industry been faced with so many competitive challenges from disruptive forces. Continuing the same conventional practices will put us and the rest of the industry on an unsustainable path. While the shift is fundamental, we already have most of the building blocks in place to put customer’s financial well-being at the heart of a new strategy. Technological advancements have been the engine of banking sector transformation and have turbocharged access to digital financial services.

In addition to using digital capabilities to accelerate synergies, the bank has rolled out a “Digital First” operating model to drive digital adoption while pursuing continuous improvements of the omni-channel customer journey and experience.

Digital-First Operating Model

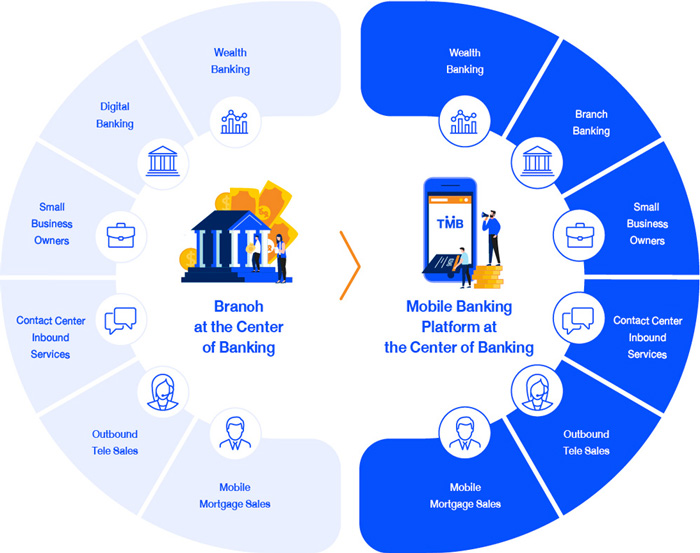

The Digital First model is based upon our goal of delivering better customer experience by putting digital at the center of ttb bank’s omni-channel offerings. To achieve it, we have changed the way we work, both within the organization and in terms of our in-branch service. Internally, we have moved toward a decentralized platform of innovation that fosters a more rapid launch of new solutions across the bank. In our branches in 2020, we leveraged digital technology to enhance the offline experience and to ultimately onboard offline customers to online. For example, instead of using typical paperwork we began servicing branch-first customers via highly secured tablets or navigated them to ttb touch, in order to familiarize them with our digital platform and to make their experience more convenient, faster and easier. In some pilot branches, floor managers can now help customers waiting in line with their transactions via ATM or ttb touch.

Innovative Solution for our Customers

Bringing digital and innovation solution to customers is part of the Bank’s digital strategy. The Bank believes that digital technology and innovative solutions play a critical role in realizing the unmet needs of customers to such an extent that the Bank fosters the adoption of a customer-focused mindset and also encourages employees to acquire innovative solutions for enhanced customer experience. We invested significantly in digital channels and financial solutions enhancement, in addition to strengthening infrastructure fundamentals and data analytics, to promote the simplicity of financial accessibility and satisfaction through insightful customer behaviors along the customer journey, while better managing operating costs.

The implication of digital technology in the new digital banking experience constituted by the Bank’s customer-centric approach, focuses on empowering customers to securely and seamlessly improve their livelihood. The Bank’s innovation culture is epitomized by ttb HACKATHON introduced in 2018, which is an in-house innovation platform that promotes cross-functional collaboration for innovative solutions in order to keep up with today’s fast-paced changes. Tangible results from ttb HACKATHON 2019 consist of Multi-currency Account, ttb SME Smart BIZ, and ttb Absolute, etc.

The continuous improvement of the Bank’s mobile banking applications is to ensure that the growing number of digital banking customers are managed in a secure and responsive manner. It is imperative for the Bank to establish digital banking platforms that are dedicated to each customer segment and their needs while promoting access to financial products and offering simple application processes.